Laura Taylor is the founder of Empowered By Cloud, a virtual finance department for trading construction businesses. Empowered By Cloud is one of only a few businesses in the UK that exclusively work with trading construction businesses.

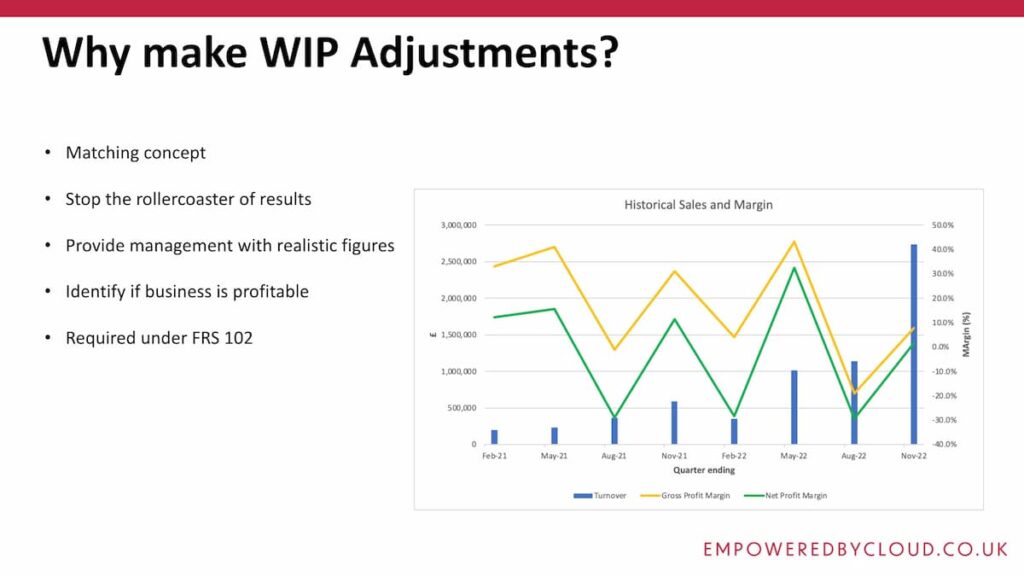

Why Make Work in Progress Adjustments?

One of the biggest areas that we find problematic in the construction sector is the ability to manage Work In Progress Costs.Today we’re going to go through why you need to calculate Work In Progress, and then how to make those adjustments.

Some of this gets a little bit into sort of accountancy terminology, but bear with me.

If you’re running a trade or construction business, you might get accounts from your accountant and you may see profit one month, lost the next month, profit the next month, loss the next.

I always describe it as a roller coaster concept. So you’ve got this up and down, up and down, and up and down.

And the reason for that up and down is because the sales and the costs are not being matched together into the period in which they relate. So at the end of the year, if you have an accountant, they will typically ask you for your Work In Progress figure to put into the accounts.

Doing a Work In Progress adjustment just once a year doesn’t really serve you any purpose because it doesn’t help you to run your business.

It will give you semi-accurate information at the year end, but all the way through the year you don’t know where you are.

So instead of having this up and down roller coaster, if you’re adjusting Work In Progress throughout each month, you will have a smoother line and you can actually see whether your business is growing and is becoming more profitable, or if you’ve got a profitability problem.

How To Calculate The Adjustment

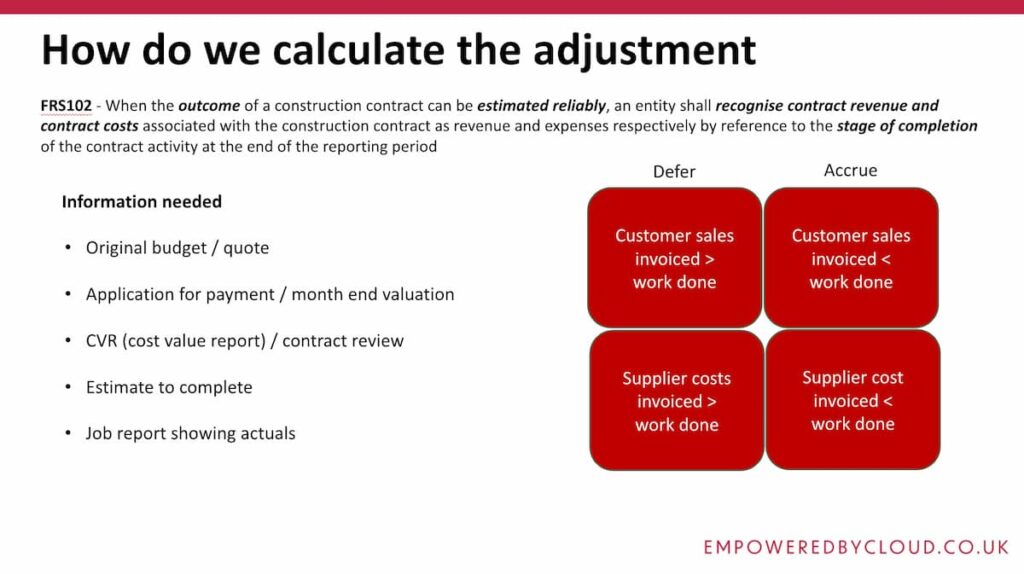

So how do we calculate adjustments? This is where we get into accounting terminology.

When the outcome of a construction contract can be estimated reliably, an entity shall recognise contract revenue and contract costs associated with the construction contract as revenue and expenses respectively by reference to the stage of completion of the contract activity to at the end of the reporting period.

Putting that simply: what needs to happen here is that you show the profit that has been earned up to that point.

If for example you were doing management accounts up to the end of February, you’d be looking to recognise the profit that had been earned up until the end of February – not more, not less.

There’s a process that you need to go through in order to be able to get information so that you can manage your Work In Progress.

To begin, you need your original budget or quote. This is so you understand what the margin was that you were pricing at initially.

Then when it comes to actually calculating your Work In Progress, you would need your application for payment or monthly evaluation.

When you’re looking at “What is the cost that’s on the job – what is the value?”, you may do contract reviews at that point. It’s also useful to look at what the estimate is to complete so that you know how much work is still to be continued to be able to complete the project.

It can be problematic if you don’t have that information because your project might not be going to plan.You might be having a problem with it that you’re maybe not aware of. Your QS might be aware of it and it’s not being passed on. That information is really important – a job report showing the actuals.

So LiveCosts is a really good way of being able to get that information because you can track the costs on every specific project. You need that information to be able to calculate Work In Progress.

Often businesses will look at starting with a Work In Progress process as such and look at it and think that’s going into the “Too Hard” box and think: “I’m not going to do that, it’s just too difficult.”

If you’re really serious about growing your business and you want to understand your profitability, you really need to be able to go through this process and it’s not as difficult as it looks. It’s just a case of getting the right processes, the right systems and then the right advisors to be able to help you to manage through.

When it comes over to these boxes at the site, sometimes within a Work In Progress adjustment, we’ll be deferring sales, accruing sales, deferring costs, or accruing costs.

Essentially, if you’re deferring sales, the customer sales have been invoiced are greater than the work that’s been done. If you’re accruing sales, the customer sales are less than the work that’s been done.

Similarly, on the cost side, if the costs invoice are greater than the work that’s been done, you’re deferring those costs. And if the supplier costs are less than the work that’s been done, you’re accruing those in.

Once you have all that information, it’s relatively straightforward to be able to make these adjustments. And this is how you can take the roller coaster away.

I always describe it as someone, a business owner is thinking about selling the family home because they think they’re doing terribly. The next month, they’re out buying a Range Rover. And that’s because they’re working on inaccurate information.

I’m going to say something: If you’re not making this adjustment, management accounts are worthless and there’s not really that much point in you having them.

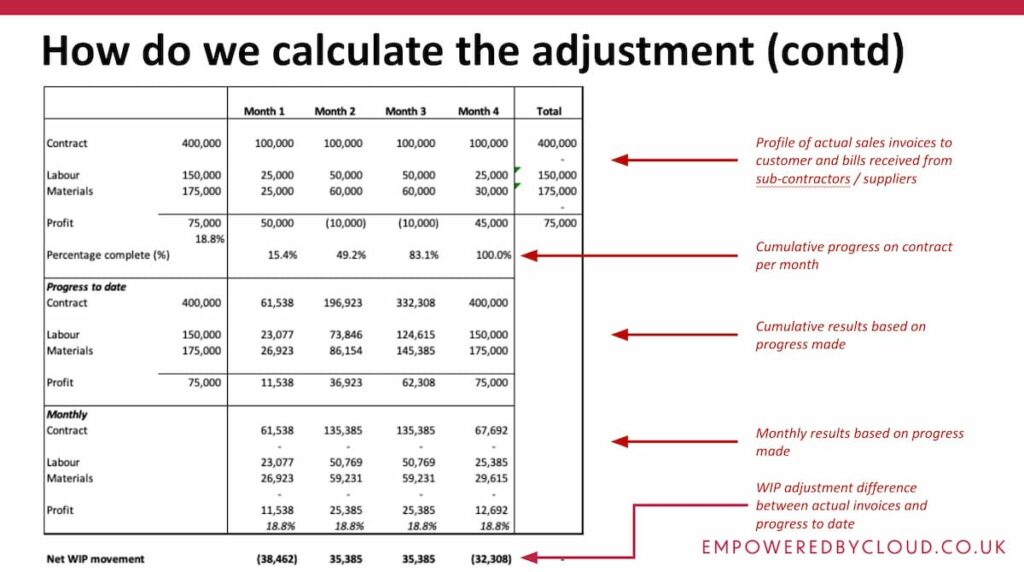

To give you an example, a contract with a value of £400,000, the labour is £150,000, the materials is £175,000, which leaves a profit of £75,000.

In month one, you do £100,000, the labour £25,000, and the materials £25,000.

You would make a profit of £50,000.

But in month two, you would have profit of £100,000, labour of £50,000, and materials of £60,000. So you’d actually show a loss of £10,000. And the same again in month three.

And then in month four, you would make a profit of £45,000. So in total, you would make profit of £75,000, as that was going on.

However, given where you actually are in terms of the progress to date, you can go down to the next part and it shows you what the progress is in month one, month two, month three and month four.

And no contracts really end up with 25%, 25%, 25%. So it becomes a completely different set of numbers that are there.

So we need to then make adjustments to those numbers to give you the actual profit that should be recognised in the month.

So in month one, there’ll be a Work In Progress movement of £38,500, £23,500 thousand pounds in month 2, month 3 £33,500 thousand pounds, and then going the other way, £32,000 in month four.

Now, overall, you’re getting to the point that all of the profit is recognised, but it’s not equal throughout the month as the costs are going through.

Areas To Watch

It’s one of the biggest areas of judgment in the financial statements.

Often when it gets to the year end, an accountant may ask a business owner for their Work In Progress. And the business owner will look at that and, because it is quite subjective, may overestimate or underestimate that number. And that’s not great for the business, because you’re not able to understand where the business is actually at and you’re making decisions based on inaccurate information.

If the outcome can’t be estimated reliably, then you don’t take the profit.

If the contract costs are going to be greater than the contract revenue, you should recognise the loss in full immediately. And a lot of people don’t do that.

So what you often see is a project that’s going along and then right at the end there’s this huge loss that pulls it down.

If you are managing Work In Progress properly, if the contract was determined to be loss making at the beginning, the loss would be recognised and it wouldn’t wait till the end.

A lot of businesses that get into trouble, get into trouble because they are recognising those losses at the end.