Webinar Replay

March 29 2023

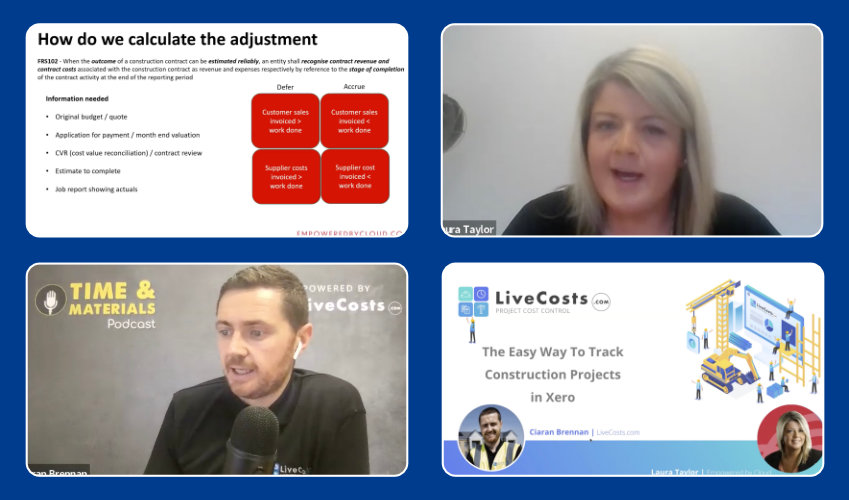

Ciaran Brennan (LiveCosts.com) and Laura Taylor (Empowered By Cloud) explain how to get more detail from your accounting software.

Discover the most important improvements you can make to your Xero process, and explore how LiveCosts can add new levels of detail to your project cost-tracking.

Introduction

Ciaran Brennan

So let me kick off. I’m Ciaran Brennan, I’m one of the co-founders here at LiveCosts, and I will quickly just go through the agenda for today.

We’re going to walk through a quick intro about ourselves. I’m going to hand over to Laura for an introduction to herself and her company. Laura’s going to be working through work in progress, progress adjustments, calculating adjustments, CVRs, all that type of stuff.

I’m then going to show a little bit on how you can work with the best of both worlds. And what I mean by that is sort of getting your accounts and your finance structure solid, but yet having the ability to work and see project values and project insights alongside having that solid financial structure.

And then we’ll open up to Q&A, which I’m sure there will be as we work through this.

In LiveCosts, we are overtaking now about 5,000 projects on the platform. We’ve seen values on the platform of over a billion. And some of the procurement tools that we’ve put in place now have helped our customers procure at the right price, as we like to say. Over €285,000,000 worth of material costs.

So as you can see straight away, we’re very much positioning ourselves on the project financial side of things. We’re currently backed by some of the global leaders. We’ve got Enterprise Ireland who are essentially the Irish government. We’ve got the Nemetschek Group, who would probably be classed as one of the leading construction software providers in the world. They would have companies such as Bluebeam and Navarros and these type of companies and we’re happy to be a part of the Nemetschek family as well. And one of the largest construction technology venture capitalist firms over London called PieLabs.

So we’re very much backed by some global players.

I’m going to drop my screen, I’m going to hand over to Laura and I’ll loop back in when Laura passes it on. So Laura, over to you.

How To Track Construction Work In Progress Costs in Xero

Laura Taylor

Thank you. Hi everybody and thanks for joining us this morning. My name is Laura Taylor and I’m the founder of Empowered by Cloud. We are a virtual finance department for trading construction businesses. There are only a few businesses in the UK that exclusively work with trading construction businesses, so we fell into that space.

I’ve got a few things that we want to touch on today. And one of the biggest areas that we find problematic in the construction sector is the ability to manage work in progress. And we’re going to go through why you need to calculate work in progress and then make those adjustments. I’m just going to share my screen.

So the things that we’re going to go through are:

- Why do we need to make work in progress adjustments?

- How do we make those adjustments?

- Areas to watch.

Construction Accounting Best Practices for Tracking Work In Progress Costs in Xero

So to kick off.

Now, some of this gets a little bit into sort of accountancy terminology. But bear with me. If you’re running a trade or construction business, you might get accounts from your accountant and you may see profit one month, loss the next month, profit the next month, loss the next.

And I always describe it as a roller coaster concept. So you’ve got this up and down and up and down and up and down. And the reason for that up and down is because the sales and the costs are not being matched together into the period in which they relate.

So at the end of the year, if you have an accountant, they will typically ask you for your work in progres figure to put into the accounts. Now, doing a work in progress adjustment once a year doesn’t really serve you any purpose because it doesn’t help you to run your business. It will give you semi-accurate information at the year end, but all the way through the year you don’t know where you are.

So instead of having this up and down, up and down roller coaster, if you’re adjusting work in progress throughout each month, you start to have a smoother line and you can actually see whether your business is growing and is becoming more profitable or if you’ve got a profitability problem.

It’s also required under the accounting standards. So under FRS 102 it’s required that you should be adjusting.

Now at the moment, if you’re only doing that at the year end, that’s okay. You’ll be meeting the accounting standards, but again, it’s not going to help you to understand what’s going on in your business.

So how do we calculate adjustments? So this is the accounting terminology:

“When the outcome of a construction contract can be reliably estimated, an entity shall recognise contract revenue and contract costs associated with a construction contract as revenue and expenses respectively, by reference to the stage or completion of the contract activity.”

Putting that simply, what needs to happen is that you show the profit that has been earned up to that point. So let’s say you were doing management accounts up to the end of February.

You’d be looking to recognise the profit that had been earned up until the end of February and not more or less.

There’s a process that you need to go through in order to be able to get information, to be able to manage your work in progress. So to start off with, you need your original budget or quote. And the reason for that is to understand what the margin was that you were pricing at initially.

Then at the period that you’re looking to actually calculate your work in progress, you would need your application for payment or monthly evaluation.

If you’re a trade business, it’s slightly different, and I’ll touch on that in a second. But if you’re working under proper construction contracts and you’re putting in applications and valuations, this is where you will get the information.

Some bigger businesses might do a CBR, so you might do a Cost / Value Reconciliation when you’re looking at what is the cost that’s on the job, what is the value? And you may do contract reviews at that point. It’s also useful to look at what the estimate is to complete so that you know how much work is still to be still to be continued to be able to complete the project.

Now, it can become problematic if you don’t have that information because your project might not be going to plan, you might be having a problem with it that you’re maybe not aware of, or your QS might be aware of it and it’s not been passed on. So that information is really important. A job report showing the actuals so LiveCosts is a really good way of being able to get that information because you can track the costs on every specific project. You need that information to be able to calculate work in progress.

Often businesses will look at starting with a work in progress process as such and look at it and think “That’s going into the ‘too hard’ box, I’m not going to do that, it’s just too difficult.” If you’re really serious about growing your business and you want to understand your profitability, you really need to be able to go through this process and it’s not as difficult as it looks. It’s just a case of getting the right processes, the right systems and then the right advisors to be able to help you to manage through.

When it comes over to these boxes at the sites, sometimes within a work in progress adjustment, we’ll be deferring sales, accruing sales, deferring costs or accruing costs.

If you’re deferring sales, the customer sales have been invoiced are greater than the work that’s been done.

If you’re accruing sales, the customer sales are less than the work that’s been done.

Similarly, on the cost side, if the costs invoice are greater than the work that’s been done, you’re deferring those costs and if the supplier costs are less than the work that’s been done, you’re accruing those in.

Once you have all that information, it’s relatively straightforward to be able to make these adjustments and this is how you can take the roller coaster away. And I always describe it as some months a business owner is thinking about selling the family home because they think they’re doing terribly. The next month they’re out buying a Range Rover and that’s because they’re working on inaccurate information.

I actually think that if you’re not making this adjustment, then management accounts are worthless and there’s not really that much point in you having them.

Example of Tracking Construction Work In Progress Costs In Xero

So this is kind of a worked example. I’m not going to go through every single line in it, but it will be made available after the call.

So to give you an example, a contract with a value of £400,000, the labour is £150,000, the materials is £175,000, which leaves a profit of £75,000. In month one, you do £100,000, the labour £25,000, the materials £25,000, you would make a profit of £50,000.

In month two, you would be £100,000, labour of £50,000, materials of £60,000, so you would actually show a loss of £10,000.

Same in month three, and then in month four, you would make a profit of £45,000. So in total, you would make profit of £75,000 as that was going on.

However, given where you actually are in terms of the progress to date, you can go down to the next part and it shows you what the progress is in month one, month two, month three and month four.

And no contracts really end up with 25%, 25%, 25%. So it becomes a completely different sort of set of numbers that are there. So we need to then make adjustments to those numbers to give you the actual profit that should be recognised in the month.

So in month one, there’ll be a work in progress movement of £38,500, in month two £35,000, month three £35,000, and then going the other way, £32,000 in month four.

Now, overall, you’re getting to the point that all of the profit is recognised, but it’s not equal throughout the months as the costs are going through. So this will be made available for you to have a look at.

Summary of Tracking Construction Work In Progress Costs In Xero

So, things to watch with work in progress. It’s one of the biggest areas of judgement in the financial statements. Often when it gets to the year end, an accountant may ask a business owner for their work in progress and the business owner will look at that and, because it is quite subjective, may overestimate or underestimate that number.

And that’s not really doing a great thing for the business because you’re not able to understand where the business is actually at and you’re making decisions based on inaccurate information.

If the outcome can’t be recognised, or can’t be estimated reliably, then you don’t take the profit.

If the contract costs are going to be greater than the contract revenue, you should recognise the loss in full immediately and a lot of people don’t do that. So what you often see is a project that’s going along and then right at the end there’s this huge loss that pulls it down.

If you are managing work in progress properly, if the contract was determined to be loss making at the beginning, the loss would be recognised and it wouldn’t wait till the end. A lot of businesses that get into trouble, get into trouble because they are recognising those losses at the end.

When looking at applications to get a guide on percentage complete, often we will have a conversation with QS. We’ll sit down and say, okay, let’s go through your applications. And is this a good indication of the percentage that you are complete? There’s a lot of further information. I’m sure that unless you’re an accountant on this call, you’re not going to go and have a look into it. But if you do want to go and get further information, FRS 102 plus 23 on Revenue has more information for you there.

And I’m going to hand back over to Ciaran.

Ciaran Brennan

Super, Laura, thank you very much. We’re going to open up that. I have a few questions here, written down straight away, that I want to ask.I might kick it off.

So to follow up on that, then there’s a clear definition on the accounting side of what we need to accurately report. The question is, how do we then get it?

Why Excel Doesn’t Work For Tracking Construction Project Costs

Ciaran Brennan

So our biggest bugbear when we were on the construction side was very much having to do this. And this is a general story. You’ve got a business owner here that’s going to QS, in the example, trying to get an understanding of where we stand the project. The QS will want to lean forward and manage into Xero or the accounts package. But the reality is that all the information just isn’t there.

So where do they go? They revert back into spreadsheets.

And it’s the data collection point that causes one of the biggest issues. And this is where we can help with a lot of these problems. We’re collecting information that’s buried in silos. We’re collecting information that’s not connected to any process and not connected to any systems.

And it’s putting a huge emphasis on the QS to actually be able to gather that information so that we can accurately report in our financial statements.

Limitations Of Using Xero and Excel Tracking Construction Project Costs

The other issue is that point that Laura made was that the QS is aware, but what about everyone else that needs to be aware about financial statements? And one of the issues is that a lot of time, especially with Xero, is that, yes, okay, there is permissions in there, but we don’t want all our QSs or our PMs or our procurement team managing where we have sensitive data.

And a lot of companies can be unsure about that. So that’s another reason why they get disconnected essentially from the main financial system.

And one of the things that we do is because we have the sync and the direct integration to Xero is we allow everyone to be connected. And we can allow everyone to be connected from a project perspective.

So it’s not from a perspective of looking at sensitive company data, but from the project’s point of view. And we can do stuff like if a QS can only manage finances on their project, well, so be it. And we can lock permissions down to say that they can only see financials on their project or certain pieces of financials on their project.

So the accounting system has to stay. We can’t get rid of that. As Laura said, we need that. We need to be able to go there, we need to be able to report.

But what we do is we just bolt that on to the side, essentially, and we’re able to connect people in a way that makes sense from a project’s point of view. The issue with spreadsheets is and this is not our own report, but an issue that we’ve come across is that if the account system gives us one piece of the pie, and we’re going into a spreadsheet, for example, to collect the information on the project, well, the facts say that there’s a good chance that those spreadsheets are actually wrong.

Again, not our data point, but various studies out there saying that almost nine in ten spreadsheets, so 88% of spreadsheets, will contain errors.

So the actual information that we’re looking at, there’s a good chance that it’s wrong, it’s a good chance it’s actually outdated. And the second thing is there’s a good chance it’s wrong.

So how then are we going to connect all these people and make sure that we have everyone connected in a way that we can clearly see it’s not just the QS on the QS’s shoulders to get an understanding of exactly where we stand on these projects.

So again, the key features that we recommend that we keep away from the accounting system.

How To Manage Construction Purchasing in Xero

Well, first of all, it’s the purchasing element. Xero is the one we’re talking about today.

Xero was never designed to be a procurement tool for construction projects. So let’s take that out of there in a way that we can smartly procure and connect that to the project.

Xero was never designed to manage the complex delivery methods we have, especially on the material side, such as multiple deliveries off ports or damaged goods. You know, all the stuff that happens in construction, again, it’s not the accountant’s job to do that.

So we take over that.

How To Add Construction Invoice Automation And Reconciliation to Xero

Invoice automation and reconciliation, we can do that.

So that not only are we looking at invoicing from a point of view of accounts payable, but we’re looking at smart stuff such as where’s the purchasing, how many purchase orders, how many deliveries?

All these questions that are very unique to construction can be managed in a construction way.

Xero will look at products and product codes. We’d look at that slightly different in terms of agreed pricing, project-specific pricing, fluctuation in material costs.

So again, we’re looking at it from a project’s point of view rather than the Xero point of view.

How To Track Construction Project Costs In Xero With LiveCosts

Subcontractors, direct labour, all that type of stuff. And what this means is when we end up with a situation where we have connectivity to project and connectivity across company. It means that the reports that we need, to talk to Laura’s point, the parts that we even need to get our hands on in order to actually report, is simple to get. It’s really easy. We have that information available to us, everybody can see it, and we can basically get the reports that we need.

And of course we want to have that Xero integration, so there’s no duplication of data.

Everything that we have on the project side is connected to what’s happening on the account side of things as well. The result of that then is that we have everybody connected.

Just to give a little snapshot, just before we jump into questions, I did want to just show something in LiveCosts that I know we’ve got customers on the call today, and even to our customers this will be new and opened up to as well. So one of the things that LiveCosts sort of was built on was the management of budget.

That’s changed now. And what’s new about it is from working with people like Laura who’ve been hammering us for a while, to say we also want to see income.

So how do we do that?

So what we’ve done is we’ve been working directly with Xero to come up with smart ways to how we can actually not just look at project costs, but how we can actually defer income now against these projects and have that data in real time. So we’re getting the best of both worlds, essentially.

And really what it looks like is now on the home screen in LiveCosts, our customers will be familiar that there was real key data points in terms of what’s happening across all our projects. So what’s happening from a cost point of view, what’s been invoiced and synced to Xero, what’s been committed and what’s remaining across all contracts. Now we have income. Okay, so what’s actually been billed? And then we can scroll down these in terms of the breakdown of costs. We can scroll down these in terms of budget alerts. So where are we in trouble?

Back to Laura’s point there, if there’s any issues on projects, we need that information in real time. We can’t be waiting on these reports to be ran.

So, budget alerts, purchasing activity. But the real value of this is that when the project owner or QS now needs to get information to senior management or to our accounting practice, with two clicks I can defer at project level and I can also go into phase at the project level. And now my data, my dashboard, is completely unique to that particular project or that particular phase of project.

So now what we can see on the income side, which is a direct pull, is actually what’s being paid. So not only are we now tracking our invoice costs versus our committed costs, versus our contract, what’s left in the contract value, we’re now tracking what’s actually being paid. So we can actually connect that straight up to the invoicing side on Xero, what’s being committed and what is left to claim. So that’s just something I know some of our customers will be keen to see that we will be releasing that and you’ll be made aware of that.

But just to give you a little look under the hood, we’re pretty excited about what that means now for our LiveCosts customers.

Questions & Answers

Ciaran Brennan

So questions? I have a few, Laura, if you don’t mind. I might just and then I’ll open up to anyone if you want to raise your hand or if you just want to pop questions in the chat, whatever way you feel more comfortable, happy. If you’d like to turn on your camera and sound as well for this.

How Do You Track Client Retention in Xero for Construction?

Ciaran Brennan

So one of the questions I have, Laura, was on the retention side, how are you dealing with retention on the client side of things?

Laura Taylor

I guess there’s two ways of dealing with retention and both are allowable from an HMRC perspective.

One is to actually just leave the retention hanging on the invoice so invoicing the full value and leaving that on the sales ledger so that it just sits there. And the only other consideration when doing that would be to provide for any retentions that you don’t think you’re going to receive.

The other way to do it is actually to invoice the retention later and actually have it sitting on a balance sheet account, which requires probably speaking to your accountant about how to set that up. But as the HMRC will allow two ways, there’s no easy fix in Xero. There’s no retention button. You just press the button and it’s going to remind you that in twelve months time, you’ve got to claim that retention that doesn’t exist. So you do still have to have a mechanism.

I prefer to have the retention sitting on the balance sheet because it’s a bit tidier. It doesn’t mess up the sales ledger so much. But you do have to remember at least monthly to go in and check those and when they’re due to be claimed.

Is Xero Better Than Sage For Construction Accounting?

Ciaran Brennan

I noticed people on this call that are currently Sage users, and are maybe considering Xero. So two parts to this question. What’s your opinion on Xero versus Sage for construction companies?

And then if there was a consideration to do a migration from something like Sage to Xero, what’s involved in that?

Laura Taylor

Yeah, so I’ve been an accountant for the last twelve years and I trained on Sage, so I know Sage really well.

And although it has developed over the years, when Xero came out, it was a game changer, just because of the user interface, how quick you can do things on the system. So much so that we’re 100% a Xero business now. We will help people move from Sage to Xero, but we don’t actually support Sage clients.

So I think that probably answers it for itself in terms of I think that Xero is a better product and it links up with more things. You can build a really nice system with all the apps that you want on it, whereas I still find Sage is a bit clunky.

How To Migrate A Construction Business From Sage To Xero

Ciaran Brennan

And on the moving. If a company was looking to move, is it difficult? What sort of time does it take?

What does the process of deciding to migrate from something like Sage to Xero look like?

Laura Taylor

A Sage to Xero migration can be very simple. There are a couple of ways of doing it. I’ve got a blog on my website, actually, on Empoweredbycloud.co.uk, that takes you really through all the steps that you need to think about.

Essentially, there’s a programme called Move My Books that you can use to migrate information from Sage to Xero.

A word of warning about using that without professional help because it can go wrong. You really need to understand how it works and what the information should be like before it comes over.

The other way of doing it is just to basically bring in the opening balances of your accounting system at your year end and basically start from scratch. If you’re starting from scratch, it’s a really good way to build a system that’s fit for purpose for your business.

As it is now, you perhaps set up Sage ten years ago and things have changed. So it’s a really nice way of setting up a new system. And you don’t lose your Sage information. You’ve always got that backup that you could restore at any point if you needed to go back and find something.

With Move My Books, you’re bringing more historical information over with you. So you do have that, but the downside of that is that you’re bringing in the same system, so your similar chart of accounts, et cetera. And if you wanted to change that, there’s a bit more work.

What Construction Project Data Does LiveCosts Track?

Ciaran Brennan

There’s a question in here from Jessica, so let me just pop this one out.

What data is being driven by Xero, which goes through LiveCosts? Our main struggle is tracking internal generated costs. So own plant and payroll labour.

How does LiveCosts deal with that and how does it feed into Xero reports? Sage has a good function on this in the form of projects where you could add costs without any impact on the P&L / balance sheet.

So there’s probably two parts of that. There’s probably a bit of on the LiveCosts side and then there’s the impact on the balance sheet. So I’ll address the LiveCosts side.

We have our own method of tracking plant and labour. Again, one of the things of separating the project, this reference to Sage is probably a good example. So Sage have tried to and if it’s Sage 50 that we’re talking about, in particular, Sage 50 have built out the project function.

But it’s a bit I think the word we use, it was a bit clunky, it’s not very user friendly. And again, it struggles to allow everybody that has an impact on the financial project to allow people into our Sage 50.

So, again, the whole concept of LiveCosts is that we can separate a project in something that’s modern, that’s slick and that’s easy to use, and everybody can understand exactly how to track those costs.

So we can then track the likes of plant, the labour, materials, subcontractors, whatever that may be, and we can sync that across into our main accounts package, whether it be Sage or we also work with Sage.

Impact on balance sheet, then, is an accounting question that would know if you’re working with someone like Laura, someone that you would discuss then on the accounting side, we essentially track the project cost, wherever that cost might be, and we sync that across into the preferred accounting system.

Does LiveCosts Have A Free Trial?

Ciaran Brennan

There’s another question in here from Sarah. Is there a free trial for LiveCosts? We use Xero looking for a cost software.

Currently just use Excel to monitor job progress. A lot of double processing. So absolutely, Sarah, yes, happy to connect.

After the call, we do offer a free trial, 14 days, where we get pretty hands on, which as well, so we don’t just give you the product and leave you be for 14 days. We essentially will work with you, get an understanding of what that spreadsheet looks like.

We love replacing spreadsheets, so we get quite a little kick of looking at a big chunky spreadsheet and being able to take it out of business. So we’re happy to do that.

Can A Construction Company Be Too Large To Use Xero For Construction Accounting?

Ciaran Brennan

I’ve got another one, Laura, as well. There’s a few companies on the call who’s construction company is probably on a larger size.

Have you found a cap, as in a revenue cap of a company where Xero becomes essentially the company are just too big to monitor Xero, where you would recommend that they don’t use Xero.

Laura Taylor

With construction companies generally? No, and the reason I’m saying that is that there’s normally not as many invoices, but larger amounts than potentially a shop that’s selling pollinats. You get a lot there with construction companies. I’ve not had any that have went over the limits.

Xero do have almost soft limits they call them. So Xero have soft limits. And off the top of my head, I don’t know them, I need to go and double cheque. But they have soft limits where they’ll say it’s a specific number of transactions, it’s nothing to do with revenue.

You could have a billion pounds on one invoice and that would be fine, but it’s to do with the number of transactions. But again, I can give anyone that information that’s looking for it. We just need to get the up to date figures.

What Drawbacks Does Xero Have As A Construction Accounting Software?

Ciaran Brennan

Just pushing back on the sort of Sage and Xero thing, if people are familiar with how sort of projects are managed in Sage, what would you feel some of maybe the shortcomings are that Xero probably needs to sharpen up on or could do better maybe when it comes to actually tracking the project reporting side of things.

Laura Taylor

When it comes to the project reporting side, you know you can get information from it, but they’re not user friendly reports. You have to remember on every single item to assign it to a project.

Whereas something like LiveCosts where you’re working from the purchase order on the project, it’s much more likely to end up on the right job as opposed to if you’ve got hundreds of invoices coming into an accounts department and they are going on to the invoice and looking for which job is it? Often they can get muddled up.

And when it comes to actually looking at reports, you’re thinking that just doesn’t make sense and it’s because they’ve been put in the wrong place.

So you can get the information, but it’s not as nice a process.

Conclusion

Unless anyone else has any questions. We did say we try and keep it within the 40 minutes, which we’ve managed to do. I am happy now to send on any of our links. Laura, if anyone wants to reach out to you separately, what’s the best place to catch you?

Laura Taylor

You can catch me on email. It’s laura@empoweredbycloud.co.uk. So if you’ve got any questions following on from today, happy to answer them. Also on LinkedIn, Laura Taylor got a lot of construction emojis after my name, so you should be able to find me on there as.

Ciaran Brennan

If on my side of things as well. It’s ciaran@livecosts.com. Nice and simple.

I’m happy to have any separate calls around any questions maybe that might come up later in the day or something that you might think about. And certainly for those that are watching the recording of this, feel free to reach out as well.

Apart from that, thanks for coming on, appreciate having you all and have a good day and we will speak again soon.